If you’re wondering where all your money goes each month, you’re not alone. Most people feel like their money just “disappears” — and that’s usually because they don’t track it.

The truth is, you can’t manage what you don’t measure. Learning to track your spending and income is the first step to gaining control over your finances.

Here’s a simple, no-jargon guide to get started.

Why Should You Track Your Spending and Income?

Tracking your money gives you clarity. It helps you:

- Know exactly how much you’re earning and spending

- Spot bad money habits

- Identify where you can save

- Avoid overspending

- Build better financial decisions

You don’t need to be great at math or a finance expert. You just need consistency.

Step 1: Know Where Your Money Comes From

Start with your income. This includes:

- Salary (after tax and deductions)

- Freelance or side hustle income

- Rent or interest income

- Any other money you receive regularly

Make a simple note of your total monthly income.

Step 2: List All Your Expenses

Now, write down everything you spend money on. And yes, everything means everything — no matter how small.

Break your spending into categories:

- Rent or housing

- Groceries and essentials

- Transport (fuel, Ola, Metro, etc.)

- Bills (electricity, mobile, internet)

- EMIs or loan repayments

- Subscriptions (Netflix, Spotify)

- Eating out, coffee, and snacks

- Shopping (clothes, gadgets, etc.)

- One-time or unexpected expenses

At the end of the month, total it up and compare it with your income.

Step 3: Choose a Method That Works for You

You can track your money using any of these simple methods:

1. Notebook or Diary

Write down your income and daily expenses by hand. It’s old-school but effective if you’re comfortable with it.

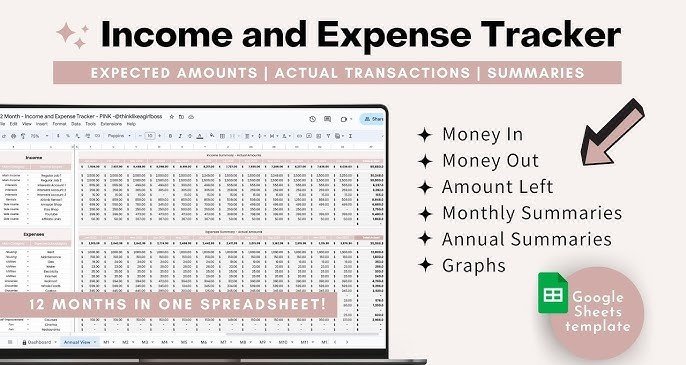

2. Excel or Google Sheets

Use a simple spreadsheet with categories. You can total your monthly income and expenses easily.

3. Mobile Apps

There are apps like Walnut, Money Manager, and Monefy that automatically track your spending and categorize it for you. Some link directly to your bank or UPI.

4. Bank or UPI Statements

You can also review your monthly bank or PayTM/PhonePe/GPay history to see where your money went.

The best method is the one you’ll actually use.

Step 4: Review Every Week

Don’t wait till the end of the month. Set aside 10 minutes every Sunday to look at:

- How much you’ve earned

- How much you’ve spent

- Where you’re overspending

- What you can cut or improve

This regular check-in keeps you aware and in control.

Step 5: Look for Patterns

After a month or two of tracking, you’ll start noticing patterns.

- Are you spending too much on food delivery?

- Are subscription charges adding up?

- Are you paying for things you don’t use?

These insights are powerful. They show you where to cut back and how to plan better.

Final Thoughts

Tracking your spending and income might feel boring at first — but it’s a habit that can change your life.

It brings awareness, discipline, and confidence. And once you start, you’ll wonder how you ever lived without it.

You don’t need to be perfect. You just need to start.

If you’re serious about building your first lakh, this is the first brick in the foundation.