Ah, the eternal Indian dilemma: “Beta, kab ghar kharid rahe ho?” (Son, when are you buying a house?)

This one question has haunted generations of Indians like a never-ending Ekta Kapoor serial. For many of us, the moment we cross 25, relatives assume we should either:

- Be married, or

- Be on our way to EMI jail with a brand-new 2BHK in Whitefield, Gurgaon, or Thane.

But is it really worth it today? Let’s break it down—with some spicy, relatable Indian examples.

1. The EMI vs Rent Rasam (ritual)

- Buying: You proudly tell people, “I’m paying ₹65,000 EMI every month for my own house.” Everyone claps. You feel like Ambani for 5 minutes.

- Renting: You whisper, “I’m paying ₹25,000 rent for the same house.” Suddenly, you’re called “irresponsible, non-committal, no-family-values.”

But hold on—if you do the math, that ₹40,000 difference is equal to:

- 80 plates of biryani at Paradise, OR

- 20 Bangalore–Goa weekend trips in sleeper class, OR

- One iPhone 16 Pro Max (with EMI, of course).

2. Location Drama

- Buying: You get pushed to the outskirts. Your “dream home” is 18 km away from civilization, surrounded by cows, two tea shops, and an under-construction metro station that will arrive in 2047.

- Renting: You live in Indiranagar, Bandra, or Jubilee Hills, 3 steps from Starbucks, 2 steps from a pub, and 1 step away from financial ruin.

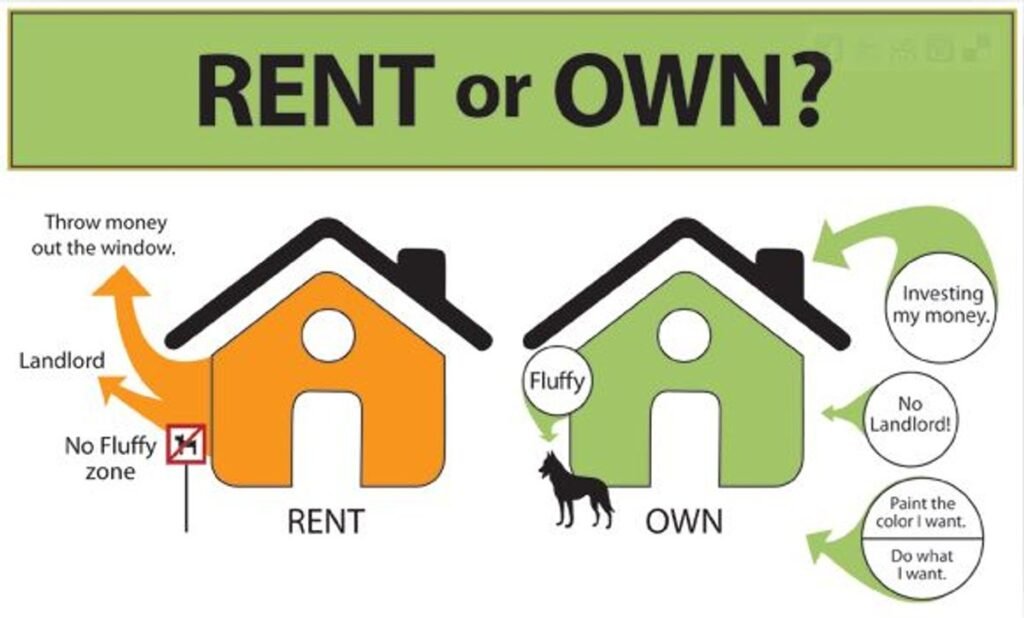

3. Emotional Quotient: Maa vs Math

- Buying: Your mom visits, touches the walls and says, “Yeh deewar pe apni beti ki height likh dena, ghar apna hona chahiye.”

- Renting: The landlord says, “Painting karna allowed nahi hai, nails mat lagana wall pe, warna deposit cut hoga.”

Conclusion: Owning means sentiment + stress; renting means freedom + wallpaper stickers from Amazon.

4. The Investment Logic

- Buying: Uncles at weddings whisper, “Property hi asli asset hai, beta.” But you soon realize your “investment” gives you a return of:

- Stray dogs as security guards,

- 5-year-old gym equipment in the clubhouse,

- And a WhatsApp group where neighbors fight about water tank timings.

- Renting: Your “investment” is in mutual funds, crypto, or that one Dubai trip where you blew half your savings.

5. Flexibility Factor

- Buying: Job in Bangalore, house in Noida? Congratulations, you are now in a long-distance relationship with your own flat.

- Renting: Job in Bangalore? Move to Bangalore. Job in Pune? Move to Pune. Job in Dubai? Leave the landlord crying with unpaid electricity bill.

6. The Desi Jugaad Way

- Buying: You will pay stamp duty, registration, interior costs, GST, parking charges (for a car you don’t even own yet).

- Renting: Your only stress is negotiating with the landlord:

- You: “Sir, 20,000 rent is too high.”

- Landlord: “Ok fine, but you pay 2 lakh deposit.”

- You: “Deposit is too high.”

- Landlord: “Ok fine, but no cooking non-veg.”

- You: *Cries in butter chicken.*

So… What Makes Sense Today?

If you want status, security, and your mom’s smile → Buy.

If you want flexibility, cash flow, and Friday night parties in Koramangala → Rent.

Honestly, in today’s India, with insane property prices, unstable jobs, and Gen-Z refusing to stay in one city for more than 8 months, renting often makes more financial sense.

But buying will always make more emotional sense.

My Take (with Masala)

- Buy if: You plan to settle in one city, don’t mind EMIs, and want to leave behind a WhatsApp group of 300 angry neighbors for your kids.

- Rent if: You like adventure, career hopping, and escaping nosy relatives with the classic line: “Arre, market dekh ke kharidna hai, abhi time nahi aaya.”