Living paycheck-to-paycheck is an exhausting cycle — one that traps millions, regardless of how much they earn. For many, the money is gone even before the month ends. But escaping this cycle isn’t about winning the lottery or earning 3x more. It’s about mindset, planning, and small consistent changes.

This guide breaks it all down — with realistic examples and actionable strategies that work even if you’re starting from zero.

What Is the Paycheck-to-Paycheck Trap?

If most or all of your income is spent on basic expenses — rent, food, EMIs, bills — with little or no money left for savings, you’re living paycheck to paycheck.

A study by ET Money showed that nearly 70% of working Indians save less than ₹5,000/month, and nearly half have no emergency savings at all.

It’s not about poverty alone — even high-income earners can fall into this trap due to lifestyle inflation.

Why It Happens

- No Budget

- Lifestyle Creep (Spending more as you earn more)

- EMIs & Debt Overload

- No Emergency Fund

- Impulse Spending & UPI Culture

- Lack of Financial Awareness or Planning

How to Break the Cycle — Step by Step

Step 1: Know Your Numbers (Financial Inventory)

Before anything else, figure out:

- Total income (net salary)

- Fixed expenses (rent, EMI, bills)

- Variable expenses (food, travel, subscriptions)

- Debt payments

- Existing savings/investments

Example: Ramesh earns ₹45,000/month. After rent (₹12,000), EMI (₹8,000), bills (₹5,000), and other expenses (₹15,000), he barely saves ₹1,000.

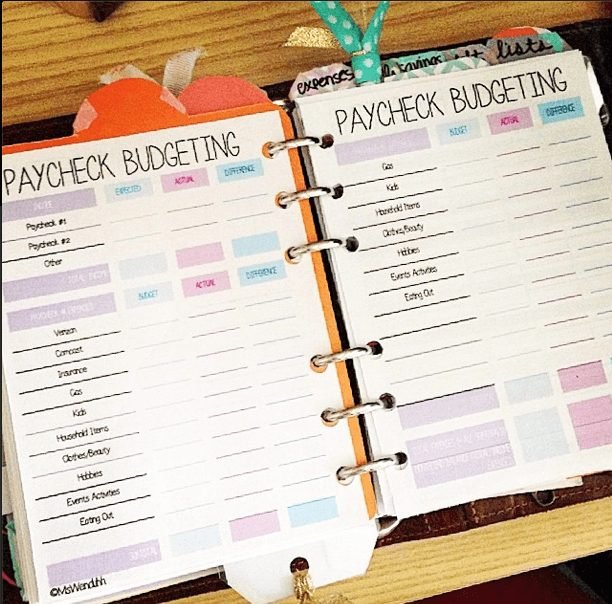

Step 2: Create a Budget You Can Stick To

Use a Zero-Based Budget or 50/30/20 rule:

- 50% Needs

- 30% Wants

- 20% Savings/Debt Repayment

Tip: Automate savings first. Spend what’s left, not the other way around.

Example: Instead of spending ₹5,000 on weekend outings, Ramesh cuts it to ₹2,500 and moves ₹2,500 to a SIP.

Step 3: Build a Starter Emergency Fund

Start with ₹10,000 to ₹25,000 as a buffer. This avoids using credit cards or payday loans in emergencies.

Use high-interest savings accounts or liquid mutual funds.

Step 4: Cut Expenses Without Feeling Deprived

- Cancel unused subscriptions (OTT, gym, apps)

- Switch to prepaid from postpaid

- Buy groceries in bulk

- Use public transport or carpool

- Cook more, Swiggy less

Real story: A user on Reddit India saved ₹8,000/month by quitting food delivery and started investing it instead.

Step 5: Increase Your Income (The Often Ignored Fix)

You can only cut so much. Increasing income is the real game-changer.

Ideas:

- Freelance (writing, design, tutoring)

- Weekend gig work

- Sell unused stuff on OLX

- Learn a monetizable skill (Excel, Canva, affiliate marketing)

If Ramesh earns an extra ₹5,000/month tutoring, he breaks the cycle faster without cutting into essentials.

Step 6: Get Rid of Bad Debt

Target:

- Credit card debt

- BNPL dues

- Personal loans

Use the Snowball or Avalanche method to pay it off faster.

Example: Pay off a ₹10,000 credit card first, then roll that EMI into the next debt.

Step 7: Automate Your Money

- Set up SIPs for investing

- Auto transfers for savings

- Fixed date for bill payments

- Use separate accounts for spending and saving

This reduces the emotional burden and helps build discipline.

Step 8: Celebrate Wins — Even Small Ones

Paid off your credit card? Built ₹10,000 in savings? That’s HUGE. Acknowledging progress keeps motivation high.

Tools to Help You

- Budgeting Apps: Goodbudget, ET Money, Jupiter

- Investment Apps: Zerodha Coin, Groww, Kuvera

- Banking Options: Auto-SIP, Savings pots (Fi, Jupiter)

How Long Will It Take?

Depending on income and lifestyle, it may take 3 to 12 months to truly break the cycle.

But the sooner you begin, the faster you’ll move from:

“I hope my salary comes today…”

to

“My money works for me now.”

Final Thoughts

Breaking the paycheck-to-paycheck cycle is hard — but not impossible. It starts with awareness, continues with action, and ends in freedom.

You don’t need a 6-figure salary. You just need a plan.

“You must gain control over your money, or the lack of it will forever control you.” – Dave Ramsey