Many people think that a big salary is the only way to become rich. But the truth is, wealth is not just about how much you earn—it’s about how you manage what you have. Smart financial habits, consistent saving, and disciplined investing can help you build wealth even with modest income. Let’s break it down with some simple infographics.

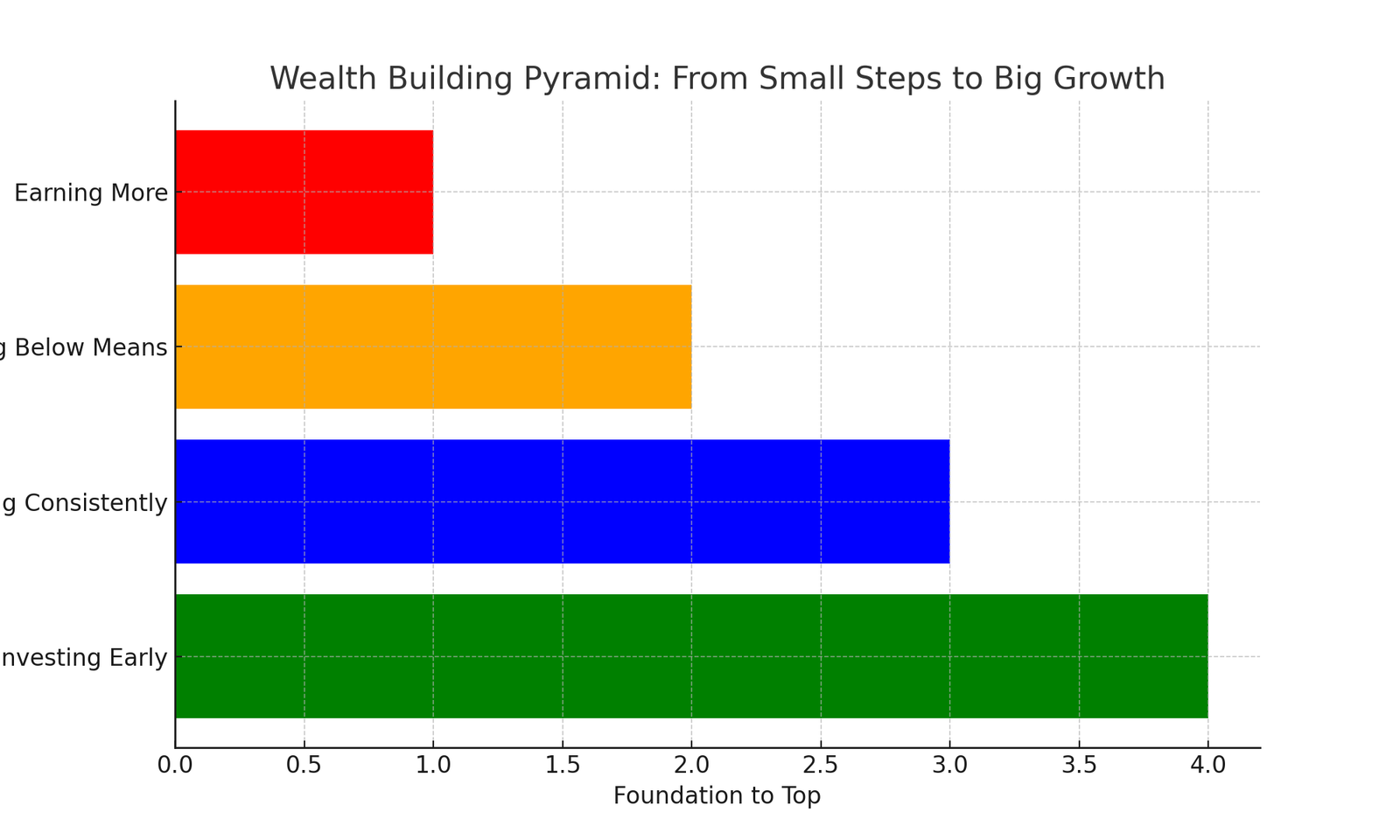

1. Wealth Building Pyramid

Wealth is built in layers, just like a pyramid. You start with a strong foundation of earning and living below your means, add consistent saving, and finally reach the top by investing wisely.

From small steps to big growth—wealth is built layer by layer.

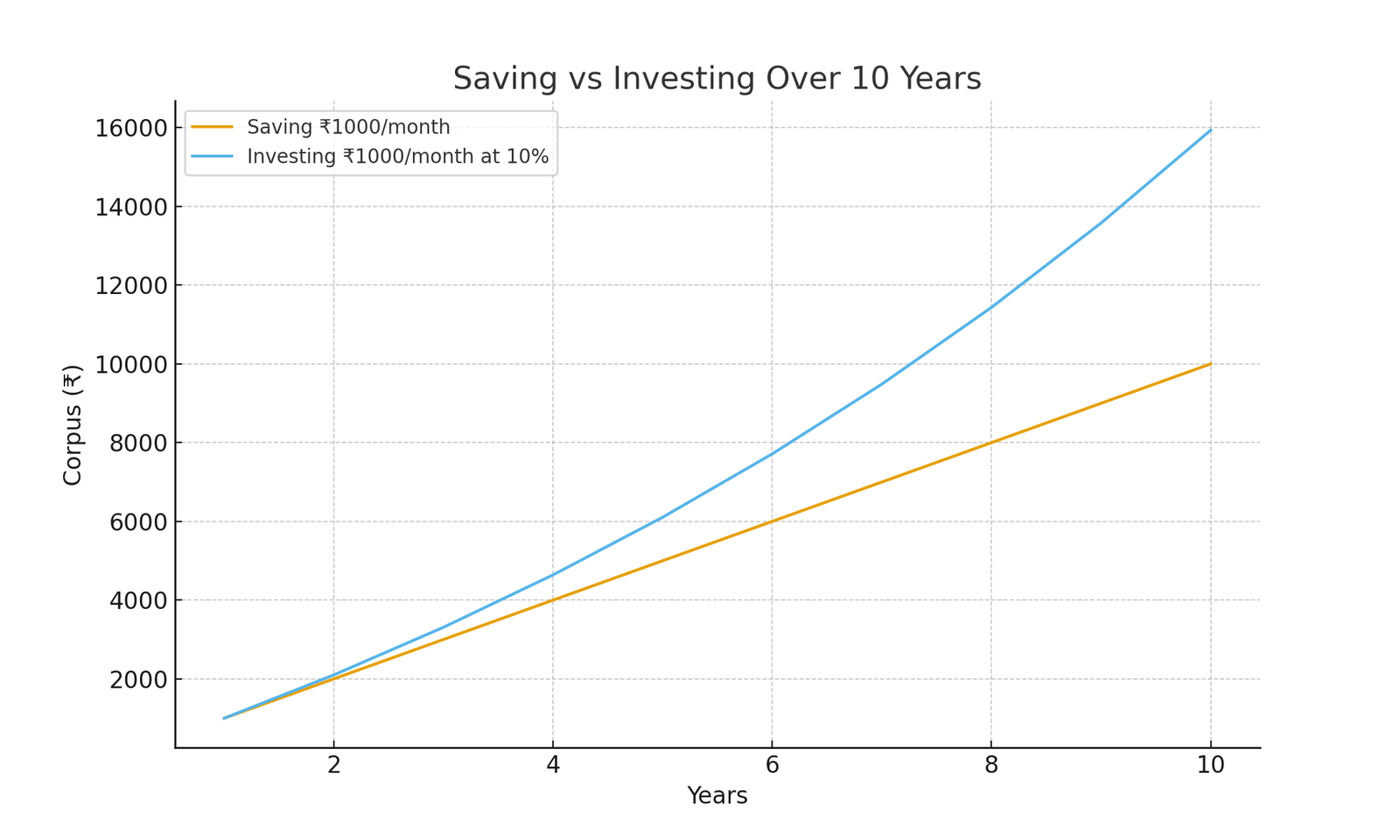

2. Saving vs Investing Over 10 Years

If you save ₹1000 per month, you’ll only have the sum of your savings after 10 years. But if you invest that same amount with a 10% return, compounding works its magic and the outcome is dramatically different.

Compounding makes your money work harder than you ever could.

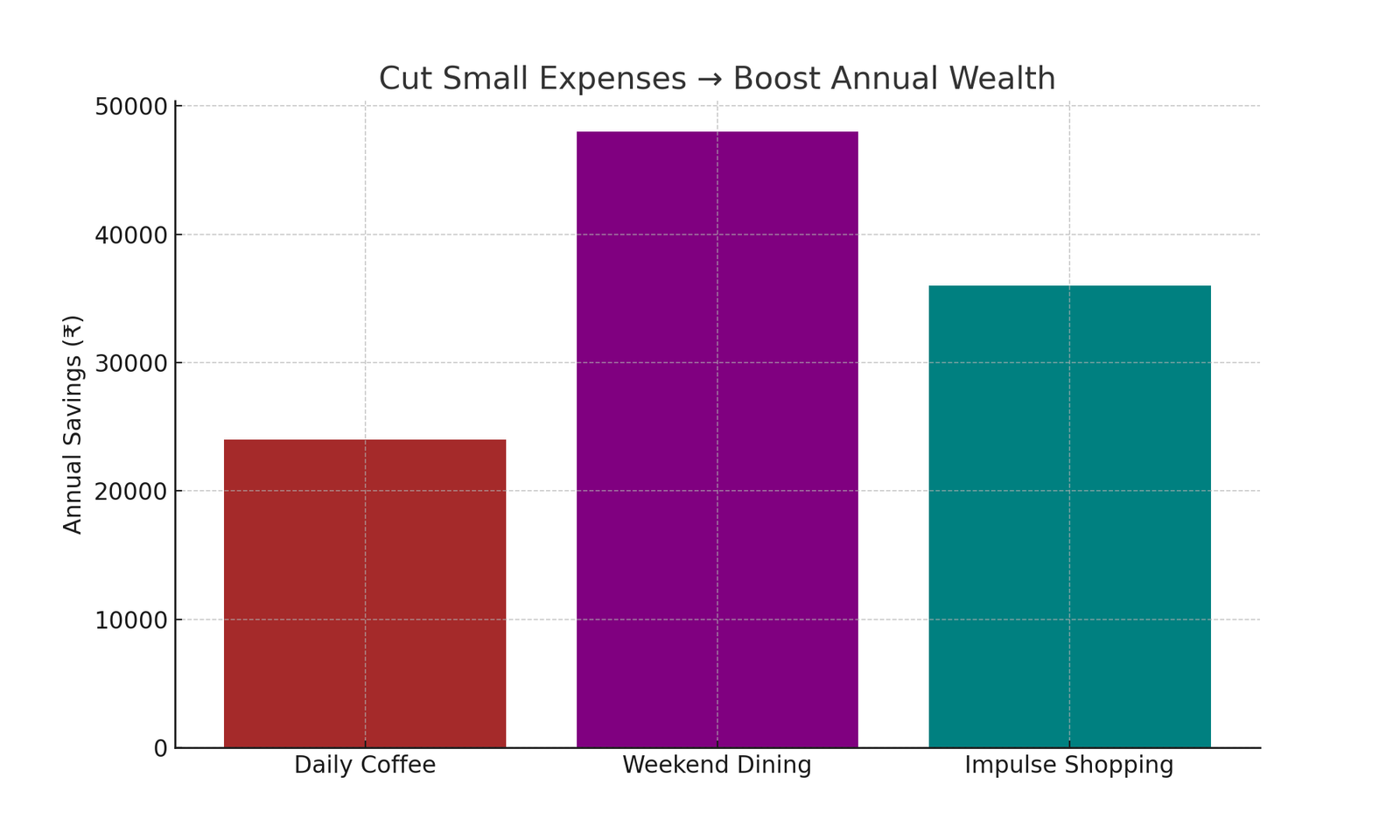

3. Cut Small Expenses → Boost Annual Wealth

It’s often the small daily expenses that quietly drain wealth. Cutting down on coffee runs, frequent dining out, or impulse purchases can add up to significant savings—and investments— each year.

Small cuts in spending = big gains in savings and investments.

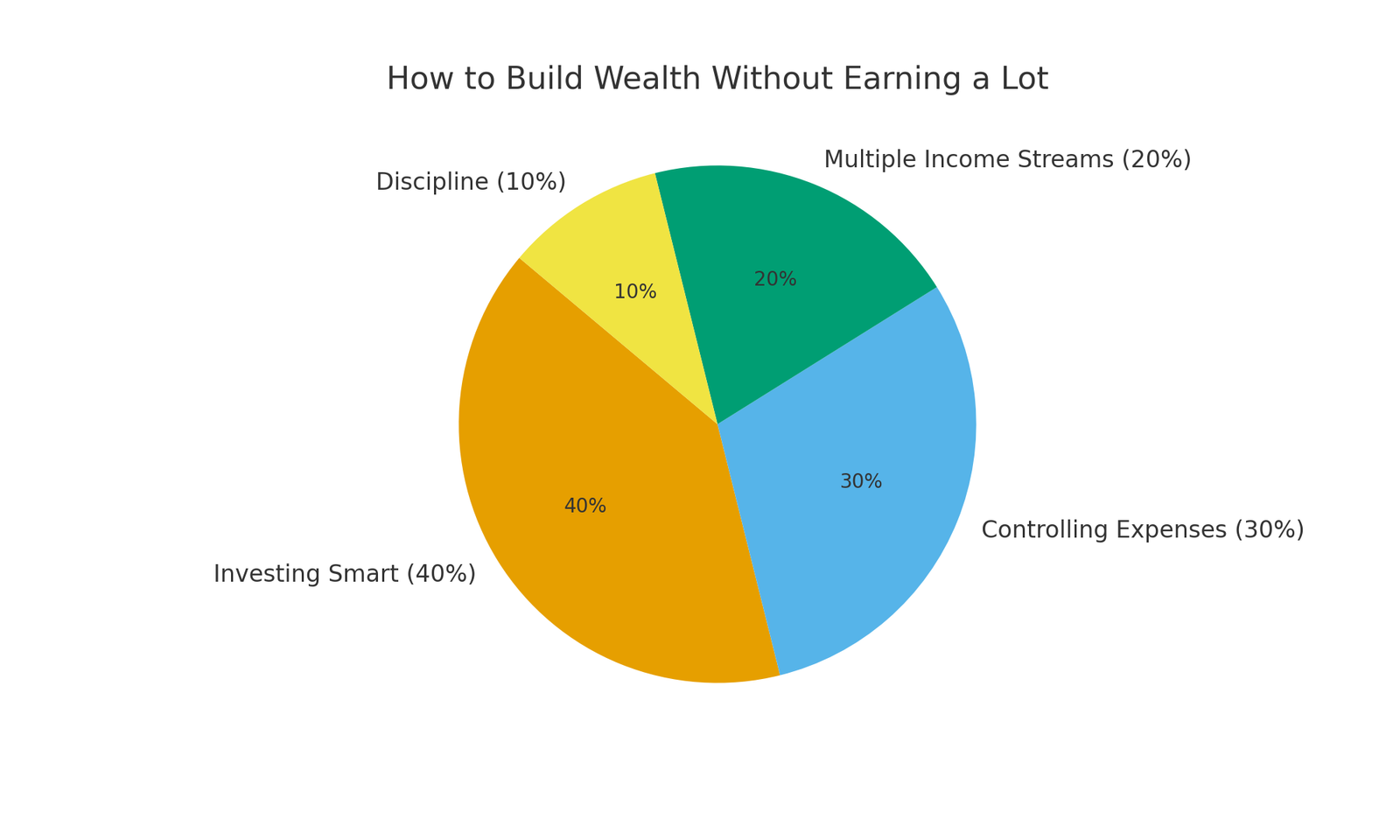

4. Wealth Without High Income: The Formula

Wealth is not about earning lakhs every month—it’s about balance. A combination of smart investing (40%), controlling expenses (30%), building multiple income streams (20%), and discipline (10%) can transform your financial journey.

The right mix of habits creates lasting wealth—even without a huge salary.

Final Thoughts

You don’t need to earn crores to build wealth. Instead, focus on controlling what you can: your expenses, your savings habits, and your investment discipline. Wealth is a marathon, not a sprint. With steady habits, you’ll reach your goals without the pressure of chasing ever-higher salaries.

Want to explore more? Check out these guides on My First Lakh for simple, practical money advice that fits your lifestyle.