“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

If you’ve heard people say, “Start an SIP,” and nodded without really knowing what it means — don’t worry. This guide is for absolute beginners who want to start their journey into investing through SIPs.

What Is an SIP?

SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly (weekly/monthly/quarterly) into a mutual fund.

Instead of investing a big lump sum, you invest small amounts over time — like ₹500, ₹1000, or ₹5000 per month.

It’s like a recurring deposit, but the money is invested in the market through mutual funds — and potentially earns better returns than a bank FD.

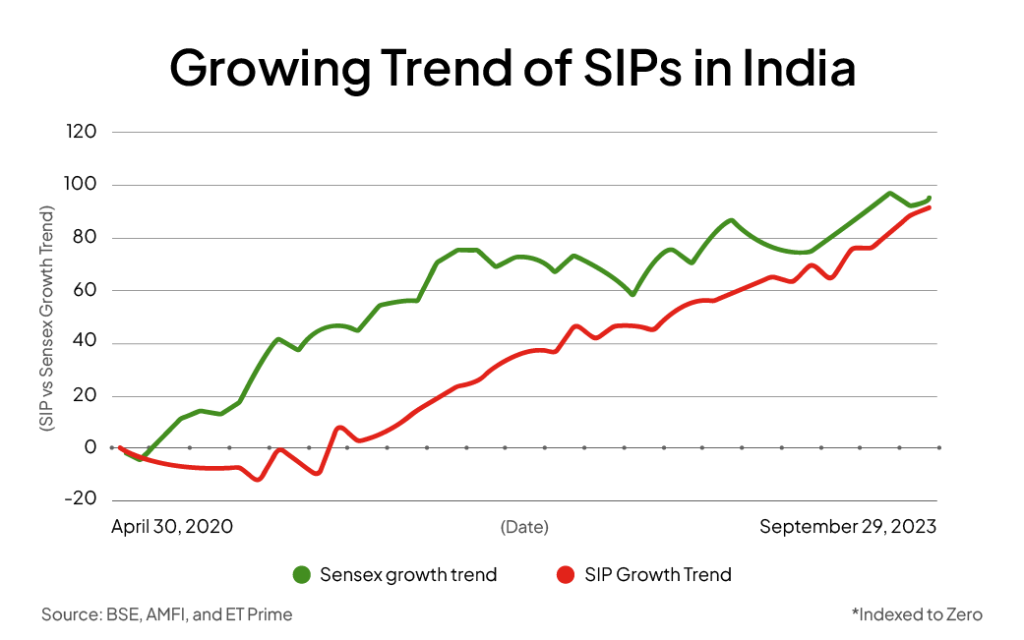

Why SIPs Are Popular in India

- SIP accounts in India crossed 7.3 crore in FY2024

- Over ₹20,000 crore is invested through SIPs every month (AMFI Data)

- SIPs are the preferred mode for over 80% of mutual fund investors

Benefits of SIPs

1. Start Small

Begin with as little as ₹100/month. No need to wait to accumulate lakhs to start investing.

2. Disciplined Investing

Automatic debits ensure you invest before you spend. Helps build a savings habit.

3. Rupee Cost Averaging

You buy more units when prices are low and fewer when prices are high. This smooths out market volatility.

4. Power of Compounding

Reinvested returns earn returns.

Example: ₹500/month for 20 years at 12% annual return → ₹5 lakh corpus on ₹1.2 lakh invested.

5. Goal-Based Investing

Plan SIPs for specific goals: education, retirement, home down payment, etc.

Types of Mutual Funds for SIPs

| Fund Type | Ideal For | Risk | Returns (Avg) |

|---|---|---|---|

| Equity Funds | Long-term goals (5+ yrs) | High | 10–15% |

| Debt Funds | Short-term goals | Low | 5–7% |

| Hybrid Funds | Medium-term (3–5 yrs) | Medium | 8–10% |

| Index Funds | Beginners | Medium | 10–12% |

| ELSS | Tax Saving (Section 80C) | High | 10–15% |

How to Start an SIP – Step-by-Step

Step 1: Define Your Financial Goal

Ask yourself:

- Why am I investing? (retirement, car, education)

- How much will I need?

- When do I need it?

Step 2: Choose the Right Fund

Use apps like Groww, Zerodha Coin, Kuvera, ET Money, or consult a SEBI-registered advisor.

Good Starter Funds:

- Nippon India Index Fund – Nifty 50

- Parag Parikh Flexi Cap Fund

- SBI Bluechip Fund

- ICICI Prudential Balanced Advantage Fund

Step 3: Complete KYC

- PAN card

- Aadhaar

- Mobile linked to Aadhaar

- Bank account

Most platforms allow e-KYC in under 5 minutes.

Step 4: Set Up Your SIP

- Choose the SIP amount (₹500–₹5000)

- Select SIP date (just after salary day is ideal)

- Link bank account via e-mandate

- Choose duration: “Perpetual” or “Until Date”

Step 5: Track and Review

- Review SIPs every 6–12 months

- Use Groww, Coin, ET Money to track performance

- Don’t stop SIPs during market dips — stay consistent

Real-Life Example: SIP Growth Simulation

| SIP Amount | Duration | Est. Return (12%) | Final Corpus |

|---|---|---|---|

| ₹1,000/month | 10 years | ₹2.3 lakh | ₹2.3 lakh |

| ₹2,000/month | 15 years | ₹10 lakh | ₹10 lakh |

| ₹5,000/month | 20 years | ₹50 lakh+ | ₹50 lakh+ |

Note: Returns are estimates based on past performance. They are not guaranteed.

Tips to Maximize SIP Returns

- Use SIP Top-Up to increase amount annually

- Invest consistently for 5+ years

- Don’t time the market — time in market matters more

- Align SIPs with financial goals

Common Mistakes to Avoid

- Stopping SIPs during market falls

- Investing without clear goals

- Mixing SIPs with savings accounts — SIPs are market-linked

- Expecting guaranteed returns — SIPs are not fixed deposits

- Investing in too many funds — stick to 2–3 max

FAQs

Q: Can I start SIP without a demat account?

A: Yes. You can invest in mutual funds without a demat account.

Q: Is there a lock-in period?

A: Regular funds usually don’t have one. ELSS funds have a 3-year lock-in.

Q: What if I miss a SIP date?

A: The SIP will resume the next month. Avoid frequent misses for long-term success.

Final Thoughts

SIPs are one of the easiest and smartest ways to build wealth over time — especially for beginners.

“The best time to start investing was yesterday. The next best time is today.”

Start small. Stay consistent. Let your first lakh — and many more — grow with time.

Need Help Getting Started?

Still confused? Email me at myfirstlakh@gmail.com or message on Instagram @myfirstlakh. I’ll help you set up your first SIP, step-by-step.