Managing money can feel overwhelming, especially if you’re not used to tracking every rupee. But here’s the truth — you don’t need a finance degree or a complicated spreadsheet to take control of your finances. Sometimes, all it takes is a simple, easy-to-follow rule.

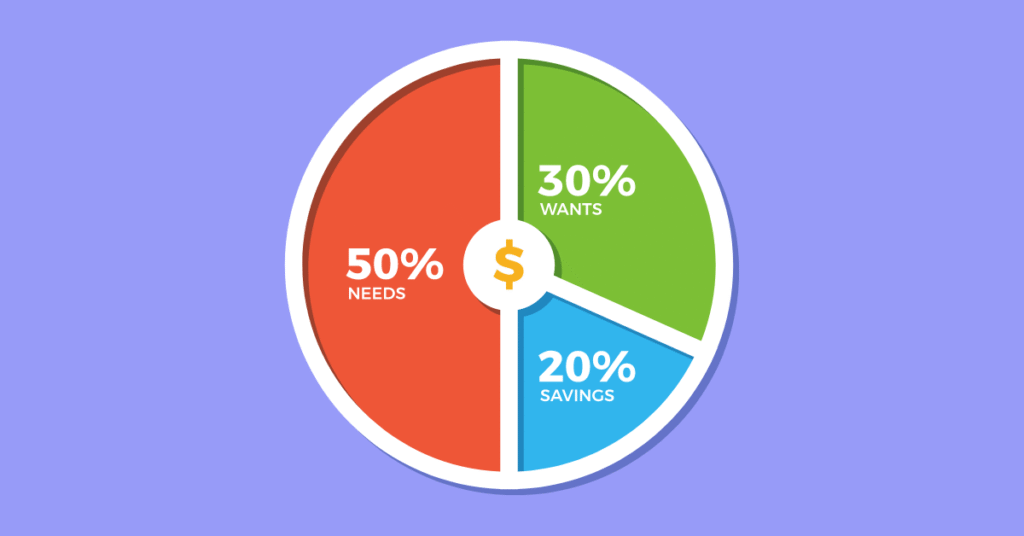

One of the most popular and effective budgeting methods is the 50/30/20 rule. In this post, we’ll break it down, look at some alternatives, and help you decide which budgeting framework is right for you — even if you’ve never budgeted before.

What is the 50/30/20 Rule?

The 50/30/20 rule is a simple and intuitive way to divide your income into three broad categories:

- 50% Needs

- 30% Wants

- 20% Savings & Debt Repayment

Let’s unpack each of these.

1. 50% – Needs

This portion of your income should cover essential expenses — things you must pay for to live and work. These are non-negotiables.

Examples:

- Rent or home loan EMI

- Groceries and utilities (electricity, water, gas)

- Transportation (fuel, public transport)

- Basic healthcare and insurance premiums

- Children’s education

Tip: If your “needs” are over 50%, it’s worth reviewing your lifestyle and exploring ways to reduce fixed costs.

2. 30% – Wants

These are non-essentials — things you enjoy but can technically live without. It’s important to acknowledge and budget for them rather than pretend they don’t exist.

Examples:

- Eating out, ordering food

- Entertainment subscriptions (Netflix, Spotify)

- Travel and leisure

- Hobbies and gadgets

- Branded clothing or beauty products

This category gives you room to enjoy your income without guilt, as long as it stays within the limit.

3. 20% – Savings and Debt Repayment

This is the most important and empowering category. It includes:

- Emergency fund savings

- SIPs (Systematic Investment Plans)

- PPF or EPF contributions

- Credit card payments

- Loan EMIs (beyond minimums)

- Retirement savings

“Don’t save what’s left after spending. Spend what’s left after saving.” – Warren Buffett

Example: Monthly Income ₹50,000

- Needs (50%): ₹25,000

- Wants (30%): ₹15,000

- Savings & Debt (20%): ₹10,000

This clear structure helps you make quick, smart decisions without getting overwhelmed.

Why the 50/30/20 Rule Works

- It’s simple: No need for detailed line items.

- It’s flexible: You can adjust categories based on your life stage.

- It builds discipline: Especially for beginners, this rule creates healthy money habits.

- It’s realistic: It allows fun and enjoyment, not just restriction.

When the 50/30/20 Rule May Not Fit

This rule may not work perfectly if:

- You live in a very high-cost city and your rent is more than 30–40% of income.

- You’re repaying large debts (like education loans).

- Your income is low or unstable.

In such cases, you may need to adjust percentages or look at alternate frameworks.

Other Budgeting Frameworks to Explore

1. The Zero-Based Budget

Every rupee you earn is assigned a job — expenses, savings, or investing — until nothing is left “unplanned.”

Pros: Super detailed and intentional

Cons: Takes more time and effort

2. The 70/20/10 Budget

A simpler variant, especially for lower-income households or those just starting.

- 70% Needs + Wants

- 20% Savings & Investing

- 10% Giving or Debt Repayment

3. The Envelope System

Old-school but still effective — especially in a cash-based culture. Divide cash into envelopes for rent, food, transport, savings, and fun. Once an envelope is empty, that’s it for the month.

4. The Reverse Budget (Pay Yourself First)

Start by saving a fixed amount every month — e.g., ₹10,000 — and then live on the rest.

Key Principle: Prioritize your savings before everything else.

Which Budgeting Method is Right for You?

| Your Style / Need | Suggested Budget Type |

|---|---|

| First-time budgeter | 50/30/20 Rule |

| Want to control overspending | Zero-Based Budget |

| Prefer simplicity | 70/20/10 Rule |

| Deal mostly in cash | Envelope System |

| Focused on savings goals | Reverse Budget (Pay Yourself First) |

Tips for Budgeting Success

- Track your expenses – Even roughly. Awareness is key.

- Adjust monthly – Life changes, and so should your budget.

- Start small – You don’t need to get it perfect. Just start.

- Use apps/tools – Try Walnut, MoneyView, or even Google Sheets.

- Reward yourself – Celebrate small wins like saving ₹5000 consistently for 3 months.

Final Thoughts

Budgeting is not about restriction. It’s about freedom — the freedom to know where your money is going, to save without stress, and to spend without guilt.

Whether you follow the 50/30/20 rule or another method, what matters is consistency and awareness. The right budget is the one you can actually stick to.

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell